MegaNews April 2025 – Six Essential Tips for a Successful Data Conversion

Six Essential Tips for a Successful Data Conversion!

Are you considering switching software providers but feeling uneasy about data migration?

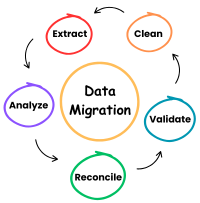

Don’t worry! With proper preparation, your data conversion can be seamless. For over 40 years, Megasys has been assisting clients with conversions, continuously refining the process to ensure a smooth transition. Understanding the key components of data conversion and how to prepare effectively will set you up for success.

1. Designate a Key Contact Within Your Organization

Assign a dedicated individual to oversee the database inquiries and another to provide general business knowledge. If your team lacks expertise in file extraction or data-related queries, consult your new software provider for guidance.

2. Access and Provide Your Extracted Data

Due to legal restrictions, most software companies cannot directly access your data. Ensure that you have the necessary access to extract and

share the required data.

3. Anticipate Multiple Data File Requests

Data conversions typically involve multiple data extractions. Here’s what to expect:

-

Initial Data Load: A preliminary import that may contain inaccuracies, requiring the first round of validation and mapping adjustments.

-

Correction-Based Validation Load: A refined import that incorporates feedback from the initial review.

-

Final Live Load: The most up-to-date dataset used for the official system transition.

4. Validate, Validate, Validate!

Collaboration is key to a successful data conversion. At Megasys, we provide a comprehensive checklist to help you verify data accuracy. Thorough validation ensures that your data remains intact and correctly structured post-migration.

5. Utilize a Test System

Your new software provider should offer a Sandbox environment or test system. This allows you to review and assess your data throughout the conversion process, making necessary adjustments before going live.

6. Confirm Post-Launch Support Availability

Even after a successful migration, questions and unforeseen issues may arise. Ensure that your provider offers robust post-launch support to assist with any concerns, ensuring a smooth transition.

By following these best practices, you can make your data conversion process as seamless and efficient as possible. With careful planning and

collaboration, you’ll be well-prepared for a successful transition to your new software system!